Fascination About Paul B Insurance

Wiki Article

Some Known Incorrect Statements About Paul B Insurance

Table of ContentsExcitement About Paul B InsuranceGetting The Paul B Insurance To WorkFacts About Paul B Insurance UncoveredMore About Paul B InsuranceFacts About Paul B Insurance UncoveredThe Best Guide To Paul B Insurance

With home insurance coverage, for instance, you might have a substitute cost or real cash worth policy. You should always ask just how cases are paid as well as what the claims process will be.

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)

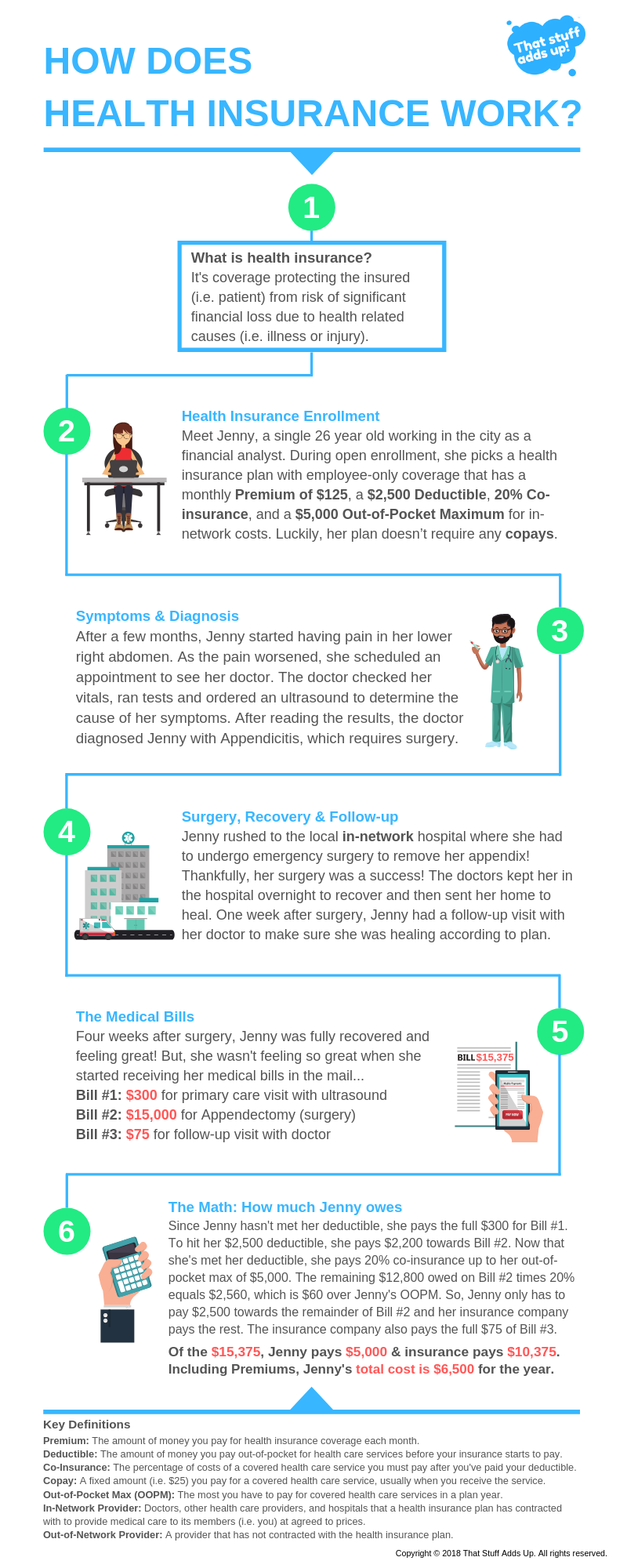

The idea is that the money paid in insurance claims over time will certainly be much less than the complete costs accumulated. You may feel like you're tossing cash gone if you never submit an insurance claim, but having piece of mind that you're covered in the occasion that you do experience a substantial loss, can be worth its weight in gold.

See This Report on Paul B Insurance

Picture you pay $500 a year to insure your $200,000 home. This suggests you have actually paid $5,000 for residence insurance.Because insurance is based on spreading the risk among many individuals, it is the pooled cash of all individuals paying for it that permits the business to develop assets as well as cover insurance claims when they occur. Insurance coverage is an organization. It would certainly be wonderful for the business to simply leave rates at the very same degree all the time, the reality is that they have to make sufficient money to cover all the potential cases their insurance holders may make.

Underwriting changes and rate increases or reductions are based on outcomes the insurance business had in previous years. They offer insurance from only one company.

The Best Strategy To Use For Paul B Insurance

The frontline individuals you handle when you acquire your insurance are the representatives and brokers that represent the insurer. They will certainly describe the sort of items they have. The restricted agent is a rep of only one insurance provider. They an aware of that firm's items or offerings, yet can not talk in the direction of other companies' policies, prices, or item offerings.Exactly how much threat or loss of money can you presume on your very own? Do you have the money to cover your expenses or debts if you have a crash? Do you have special requirements in your life that need added protection?

The insurance you need differs based on where you are at in your life, what sort of assets you have, and what your long-term goals and also tasks are. That's why it is crucial to put in the time to discuss what you want out of your policy with your agent.

Little Known Questions About Paul B Insurance.

If you secure a finance to buy a car, as well as then something happens to the car, void insurance will pay off any part of your loan more information that basic automobile insurance does not cover. Some lenders require their debtors to carry void insurance coverage.The primary function of life insurance coverage is to provide cash for your beneficiaries when you die. Depending on the type of policy you have, life insurance policy can cover: Natural deaths.

Life insurance policy covers the life of the insured individual. The policyholder, that can be a different person or entity from the insured, pays costs to an insurer. In return, the insurance company pays out a sum of money to the beneficiaries noted on the plan. Term life insurance coverage covers you for a duration find this of time chosen at acquisition, such as 10, 20 or three decades.

Paul B Insurance Can Be Fun For Everyone

Term life is prominent since it uses large payouts at a reduced cost than long-term life. There are some variants of normal term life insurance policy policies.Irreversible life insurance coverage plans develop cash money value as they age. The cash value of entire life insurance policy plans grows at a set price, while the money worth within global plans can change.

$500,000 of entire life coverage for a healthy 30-year-old woman expenses around $4,015 every year, on average. That same degree of like it coverage with a 20-year term life plan would set you back an average of regarding $188 each year, according to Quotacy, a brokerage firm.

Paul B Insurance Things To Know Before You Get This

Report this wiki page